Is Now a Good Time to Buy a Home in Madison? Here’s the Truth for 2025 Buyers

Is Now a Good Time to Buy a Home in Dane County? Here’s the Truth for 2025 Buyers

Happy couple celebrating their new home purchase in Dane County, Wisconsin, holding house keys and smiling.](happy-couple-new-homeowners-dane-county-wisconsin.jpg true! Dane County buyers are still unlocking new beginnings in 2025.

If you're a buyer in Dane County—from Madison to Waunakee, Sun Prairie, or DeForest—you’re probably asking yourself: Is now a good time to buy a home?

The answer? Yes—but only if you understand today’s strategies.

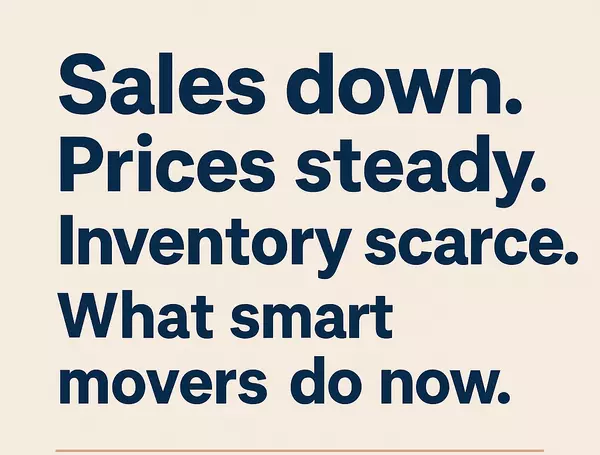

The 2025 housing market isn’t the same as it was a year ago. Interest rates are still elevated, inventory is tight, and many buyers feel stuck on the sidelines.

But here’s the good news: the tide is shifting for smart, prepared buyers. And as you can see above, people are still finding their keys to a new home and a fresh start.

Affordability Isn’t Gone—It Just Looks Different

Let’s get real—monthly payments matter. While rates are higher than in the early 2020s, Dane County buyers are using creative tactics to make homeownership more affordable:

-

Assumable Mortgages: Some VA and FHA loans let you take over a seller’s lower rate.

-

ARMs (Adjustable-Rate Mortgages): Lower starting rates for buyers who plan to move again in 5–7 years.

-

Builder Incentives: In places like Sun Prairie and DeForest, new construction offers rate buy-downs, upgrades, and even reduced base pricing.

These aren’t just “workarounds”—they’re strategic tools that can bring homeownership back within reach.

Prices Are More Flexible Than You Think

Did you know nearly 1 in 5 homes in Dane County have seen price reductions recently?

That’s a sign of softening—and increased negotiation power for buyers.

Sellers know the market is different than 2022, and they’re adjusting.

That’s your chance to get in without overpaying.

And it’s not just the prices—terms are more negotiable too.

Seller Motivation Is High

Across the country, 46% of sellers are offering concessions like paying for closing costs, repairs, or even rate buy-downs.

In Dane County, we’re seeing the same trends—especially with sellers who are relocating, downsizing, or already under contract elsewhere.

With the right offer and agent strategy, you can walk into a home with thousands in seller-paid benefits.

New Construction = New Opportunities

If you’re having trouble finding the perfect home in the resale market, don’t overlook new builds.

Builders in areas like Waunakee and Sun Prairie are stepping up their game:

-

Free upgrades like quartz counters and luxury flooring

-

Closing cost assistance

-

Extended warranties

-

And yes, rate incentives through preferred lenders

In today’s market, new construction is one of the best paths to affordability and value.

Buying a Home Should Still Be Exciting

Just look at the couple above—that’s the feeling we want for every client. One of our recent buyers, Mike Swartz, put it perfectly:

“You made it painless and exciting.”

Even in this market, that’s still possible. You just need a trusted guide who knows the terrain, has your back, and understands today’s strategies.

That’s where we come in.

At Integrity Homes, we specialize in helping veterans, first-time buyers, and local heroes navigate the housing market with confidence and clarity.

Whether you’re buying in Madison, Waunakee, or anywhere in South Central Wisconsin, we’re here to help you create a custom plan that works for you.

Ready to Buy Smart in 2025?

Let’s talk strategy—not pressure.

Whether you’re ready now or just exploring your options, I’m here to help you make a confident decision with real numbers, local insights, and a whole lot of respect for your goals.

Let’s break down your options together. Affordability isn’t gone—it just looks different in 2025.

DM me or text 608-669-4226 to create a plan that works.

Frequently Asked Questions

How is the housing market for buyers right now?

It’s more buyer-friendly than it looks. Nearly 20% of listings have reduced their price, and sellers are more open to concessions than they’ve been in years. Creative buyers are using assumable mortgages, rate buydowns, and builder incentives to offset costs. It’s not the wild west of 2021—but that’s a good thing. You have more leverage now.

How will Trump affect the housing market?

Presidential elections create uncertainty, but housing is hyper-local. In Wisconsin, the real drivers are still inventory, local job growth, and affordability. Election year headlines don’t change the fact that people still need homes—and in Dane County, demand continues to outpace supply.

Is Wisconsin a buyers or sellers market?

Right now, most of Wisconsin—including Dane County—is in a transitioning market. Inventory is rising slightly, price growth is stabilizing, and buyers have more room to negotiate. It’s not a full-on buyer’s market yet, but it’s more balanced than it’s been in years.

Do sellers pay closing costs in Wisconsin?

They can—and often do. Especially in today’s market, many Wisconsin sellers are offering to cover closing costs as part of the negotiation. Nearly half of sellers nationwide are offering concessions like this.

How much are closing costs on a $250K house?

In Wisconsin, typical buyer closing costs range from 2% to 3% of the purchase price. On a $250,000 home, that’s $5,000 to $7,500. But you don’t always have to pay that out of pocket. Between lender credits, Homes for Heroes savings, and seller concessions, many buyers end up paying far less at closing than they expect.

🎥 Check out our YouTube Channel for more real estate tips and local market insights—don’t forget to subscribe!

🔗 Follow & Subscribe:

Website: integrityhomeswi.com

Facebook: facebook.com/integrityhomeswi

Instagram: @integrityhomeswi

John Reuter

🎖️ Realtor | USAF (Ret.)

📞 Call/Text: 608-669-4226

📧 john@integrityhomeswi.com

🏡 Real Broker, LLC

Ready to unlock your own happy ending in Dane County? Let’s make it happen—together.

Categories

- All Blogs (197)

- All Things Waunakee (7)

- Benefits (7)

- Communities (9)

- Decorating (7)

- Deployment (2)

- Easements (3)

- Energy Efficiency (4)

- First-Time Homebuyers (22)

- Home Inspection (1)

- Home Selling (19)

- Home Value (13)

- Homes for Heroes (8)

- Housing Assitance (7)

- Interest Rates (5)

- Market Trends (60)

- VA Loans (5)

- Veterans (8)

- Waunakee Housing Market (2)

- Well, Water, Septic Systems (4)

Recent Posts

GET MORE INFORMATION