Home Loans for Nurses in Wisconsin

Your Complete Guide to Every Loan Option Available in 2025

🏠 Ready to Find Your Perfect Home Loan?

Wisconsin nurses save an average of $4,200+ working with us

No obligation • No credit check to start • Expert guidance

Which Loan Type is Right for You?

As a healthcare professional in Wisconsin, you have access to multiple home loan options. Each has unique benefits, requirements, and costs. This guide breaks down every option to help you make the best choice for your situation.

💡 Quick Tip: Start Here

Most nurses qualify for multiple loan types. The "best" loan depends on:

- Your down payment amount (0%, 3%, 5%, 10%, or 20%)

- Your credit score (580, 620, 640, or 700+)

- Where you're buying (urban, suburban, or rural)

- Your military service (if any)

- Whether you're a first-time buyer

💰 Save Thousands with Expert Guidance

Get personalized loan recommendations based on your unique situation

Quick Comparison: Which Loan is Best for Your Situation?

Not Sure Which Loan is Best?

Let our experts analyze your situation and recommend the perfect loan

Ready to Apply for a Conventional Loan?

Get multiple rate quotes and save $4,200+ with Reward Our Heroes

FHA Could Be Your Best Option!

Low credit? Small down payment? We'll help you qualify

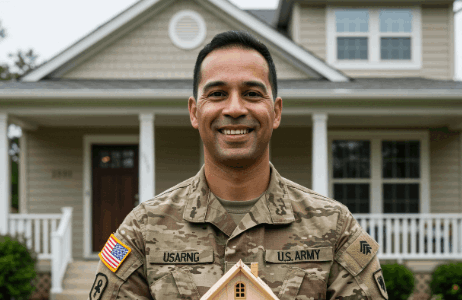

Veterans & Active Military: You've Earned This!

Zero down payment • No PMI • We handle all VA paperwork

Rural Nurses: Get Your Dream Home with Zero Down!

Check if your area qualifies for USDA financing

Ready to Find Your Perfect Loan?

Get a personalized loan comparison showing:

📞 Call 608-492-0515No obligation • No credit pull • Just honest advice

Website: RewardOurHeroes.com

Prefer Integrity Homes directly? Call 608-669-4226.